Navigating the cost of childcare in Singapore can be challenging. With preschool fees that often exceed a thousand dollars per month, understanding and utilising available childcare subsidies is essential for making quality education more affordable. Recent updates to subsidy policies have expanded access to financial support, helping more families reduce their childcare expenses.

In this guide, we will explore the different types of childcare subsidies available, how to apply for them, and the financial impact they can have. By the end, you'll be equipped with the knowledge to maximise your benefits and ensure your child receives the best possible start in life

What Are Childcare Subsidies?

Childcare subsidies are financial aids provided by the Singapore government to reduce the cost of childcare and preschool services. Their primary purpose is to make early childhood education more accessible for families, alleviating some of the financial burdens associated with raising young children. By lowering out-of-pocket costs, these subsidies help ensure that all children can benefit from quality early education.

Types of Childcare Subsidies in Singapore

Understanding the different subsidies can help you determine which ones you’re eligible for and how they can assist with your childcare or preschool expenses. Here’s a breakdown of the main types:

Government Childcare Subsidies From ECDA

The ECDA Childcare Subsidy aims to support parents by reducing the overall cost of childcare by offering financial assistance to families with children enrolled in licensed child care centres.

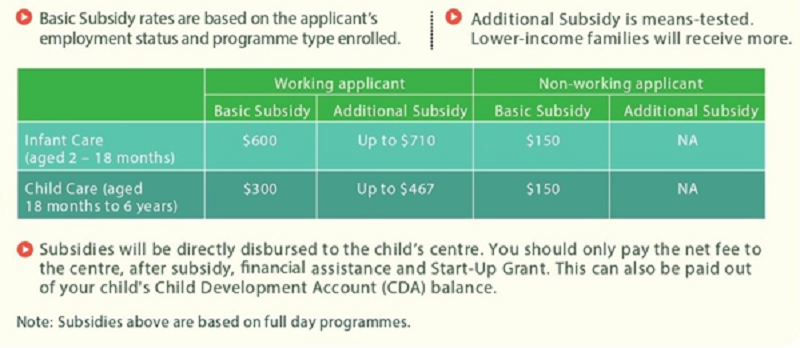

Image Source from ECDA Website

Subsidy Amount:

- Basic Subsidy: a working applicant is entitled to a basic subsidy of $300 when enrolling children 18 months and above to a preschool. Meanwhile, non-working applicants are given a basic subsidy of $150 for childcare enrolment, with no additional subsidy.

- Additional Subsidy: Depending on the family’s income, additional support can be provided. This can be up to $467 per month, depending on income levels and the number of dependants.

Eligibility:

- Singaporean children enrolled in licensed child care centres are automatically eligible to a basic subsidy

- Eligibility for additional subsidy is based on the family’s gross monthly household income (i.e. $12,000 and below) and other criteria such as the number of dependants (i.e. Five or more members living in the same household, including at least three dependants with no income.)

Enhanced Preschool Subsidies for Childcare in Singapore

With enhanced preschool subsidies introduced in recent years, more families now enjoy higher subsidies on their children’s preschool fees. The Enhanced subsidy is part of the broader ECDA scheme but is specifically aimed at offering greater support compared to the basic ECDA Childcare Subsidy.

- Basic Subsidy Eligibility: Applicants must be enrolled in a preschool centre licensed by the Early Childhood Development Agency (ECDA). The amount of basic subsidy is dependent on the programme type of the enrolled child and the employment type of the working applicant.

- Additional Subsidy Eligibility: Applicants that qualify for this needs-based subsidy provides lower-income families with an extra amount in addition to the basic subsidy. Eligibility requirements are as follows:

-

Families with working mothers or single fathers and a gross monthly household income below $12,000 may qualify for an additional subsidy, up to $467 per month. Eligible applicants must work a minimum of 56 hours per month, which can include full-time, part-time, or freelance arrangements

-

Families with at least five members, including three dependants who do not work (e.g., a dual-income family with three kids), can use their per capita income (PCI) to determine if they qualify for increased Additional Subsidies

-

Parents can refer to the ECDA website for more information on childcare subsidies.

Kindergarten Fee Assistance Scheme (KiFAS)

For parents who opt to put their children in a kindergarten programme instead of childcare, there are subsidies to avail as well.

The subsidy that eligible families can receive from KiFAS ranges from $21 to $170 monthly and this is determined through means-testing, with disadvantaged families receiving more to support their children’s education.

To be eligible for KiFAS, your children must be enrolled in a kindergarten run by an Anchor Operator or the Ministry of Education (MOE).

Special Approval Grants

What options do you have if you require more support, but do not meet the requirements set out by ECDA? There is a special approval grant that you can apply for, which will be considered on a case-by-case basis.

Special Approval Grants aim to offer financial assistance to families facing specific challenges that may prevent them from qualifying for standard childcare subsidies. These grants help ensure that children from diverse family situations can still access quality childcare services.

Considerations under special approvals include parents who are not working due to the following circumstances:

- Looking for a job

- Studying/Training/On course for at least 56 hours a month

- Pregnancy

- Medically unfit for work

- Taking care of sick or special needs family members

- Caring full-time for a child under 24 months

- Incarcerated

Do note that alternative caregivers such as grandparents, legal guardians and foster parents may also apply for the special approval grant. Moreover, applicants will need to provide relevant documents to support their application and prove their circumstances.

Bonus: Tax Reliefs for Childcare Costs for Foreigners and PRs in Singapore

While childcare subsidies are primarily available to Singaporean citizens, there are significant tax relief opportunities that can help reduce the financial burden of childcare for foreigners and Permanent Residents (PRs) residing in Singapore. These tax reliefs, offered by the Inland Revenue Authority of Singapore (IRAS), provide cost-saving benefits to eligible tax residents.

Tax Residency Status

To qualify for these tax reliefs, you must be a tax resident in Singapore. As per IRAS guidelines, you are considered a tax resident if you reside in Singapore for at least 183 days in a calendar year or are a Singapore PR or a foreigner holding an Employment Pass or S Pass, provided you meet the residency criteria. For more details on tax residency, visit IRAS Tax Residency.

Parenthood Tax Rebate

One of the key tax reliefs available is the Parenthood Tax Rebate. This rebate is designed to support working parents, including foreigners and PRs, by providing a tax reduction based on the number of children. For each child, the rebate amount varies, and it can significantly ease the financial load of raising children. For more information on the Parenthood Tax Rebate, including how much you can claim, visit Parenthood Tax Rebate.

Additional Tax Reliefs

Beyond the Parenthood Tax Rebate, other tax reliefs may be available for married couples and families. These include:

- Qualifying Child Relief: Available to parents supporting children below 16 years old, or studying full-time.

- Working Mother’s Child Relief: For working mothers with children, this relief helps offset the costs of child-rearing.

For a detailed overview of all available tax reliefs and how to apply, visit IRAS Tax Reliefs.

By leveraging these tax reliefs, foreigners and PRs can benefit from significant cost savings, helping to manage childcare expenses more effectively.

How to Apply for Childcare Subsidies

Applying for childcare subsidies is straightforward if you follow these steps:

- Check Eligibility: Ensure you meet the criteria for each type of subsidy.

- Prepare Documents: Collect necessary documents such as proof of income, employment, and proof of your child’s enrollment in a licensed institution.

- Submit Application: Apply through the Early Childhood Development Agency (ECDA) website or directly at your preschool.

- Follow Up: Monitor your application status and provide additional information if required.

Required Documents

- Proof of income (e.g., salary slips, tax returns)

- Proof of employment (e.g., employment letter)

- Proof of child’s enrollment

Application Tips

- Ensure all documents are current and accurate.

- Verify eligibility criteria to avoid errors.

- Seek assistance from the ECDA or your preschool if needed.

Financial Impact of Childcare Subsidies

Childcare subsidies can significantly reduce the financial burden of preschool education. Here’s an example of how these subsidies can affect your monthly costs:

| Program | Monthly cost before subsidy | monthly subsidy | monthly cost after subsidy |

|---|---|---|---|

| Full-Day Program | $ 1,200 | $ 500 | $700 |

| Half-Day Program | $ 800 | $ 300 | $ 500 |

| Kindergarten Program | $ 500 | $ 150 (KiFas) | $ 350 |

By applying these subsidies, families can significantly lower their childcare expenses. For example, a family receiving $500 in subsidies for a full-day program costing $1,200 will only pay $700.

Cost of Childcare Fees at Little Footprints Preschool

At Little Footprints Preschool, we offer a range of programs designed to provide quality education at affordable rates. Here’s how subsidies can make our programs more accessible:

- Full-Day Programme: Taking effect on 2025, full-day programme costs will start at $680 per month; with a $300 basic subsidy, the cost is reduced to $380 per month.

- Half-Day Programme: Costs $920 per month; with a $300 subsidy, the cost is reduced to $620.

By utilising available subsidies, you can make quality preschool education more affordable for your child. Please refer to our preschool fees and take a look at the options available to you.

At Little Footprints Preschool, we provide quality preschool education at an affordable price and all nationalities are welcome to join us.

Plan Your Visit to Little Footprints Preschool Today

Now that you have a clearer picture of the types of subsidies that you are entitled to, let’s take the next step and book a tour of your preferred preschool!

Little Footprints Preschool welcome all parents to get in touch with us and enquire about our programmes and availability for your children.

Come and have a look at our centres located island-wide, before you enrol your children with our caring and passionate education team!

Frequently Asked Questions (FAQs)

- What is the difference between basic and additional subsidies?

Basic subsidies are available to all eligible families, while additional subsidies are based on income and family size.

- How do I apply for a special approval grant?

Apply by providing documentation of your exceptional circumstances through the ECDA website or your preschool.

- Can grandparents apply for subsidies if they are the primary caregivers?

Yes, grandparents and other alternative caregivers can apply for special approval grants if they meet the criteria.

- What happens if my income changes after I apply for a subsidy?

Notify the ECDA or your preschool immediately if your income changes, as it may affect your eligibility for additional subsidies.

- How long does it take to process a subsidy application?

Processing times can vary. Generally, it takes a few weeks, but you should follow up with ECDA or your preschool for the most accurate time frame.

- Can I apply for multiple subsidies at the same time?

Yes, you can apply for multiple subsidies if you meet the eligibility criteria for each. Ensure you provide all necessary documentation for each application.

- What should I do if my application is rejected?

If your application is rejected, review the feedback provided and address any issues. You may also appeal the decision or seek further assistance from the ECDA.

- Are subsidies available for part-time childcare programmes?

Yes, subsidies are available for both full-day and half-day programmes. The amount may vary depending on the type of program and your family's eligibility.

- Can I receive subsidies if I use a private childcare provider?

Subsidies are available for licensed childcare centres and kindergartens. Ensure your provider is registered with the Early Childhood Development Agency (ECDA) to qualify for subsidies.

- Are Singapore PRs eligible for a childcare subsidy?

Foreign parents in Singapore do not have access to the same childcare subsidies as Singaporean citizens, but they should explore available tax relief, private provider options, and potential support through their employers or expatriate networks to manage childcare costs effectively.

Follow us on social media to get our latest updates and happening: